CBSE Class 12 Economics Exam 2025 took place on 19th March 2025. According to the preliminary reaction of the students, the paper was of a moderate level. To assist the students in their performance evaluation, we have supplied the CBSE Class 12 Economics Answer Key 2025 in this post. The answer key has been designed by experts in the concerned subject and will act as a valuable tool for the students in verifying their solutions and estimating scores. By using the answer key, students can learn from their errors and enhance their preparation for subsequent exams.

CBSE 12th Economics Exam Answer Key: Highlights

The CBSE 12th Economics question paper includes 34 questions carrying 80 marks. The exam duration was 3 hours. Most of the questions are mandatory while few questions had internal choices.

| Feature | Highlights |

| Board Name | Central Board of Secondary Education (CBSE) |

| Exam Name | CBSE Class 12th Economics Exam |

| Exam Date | March 19, 2025 |

| Duration | 10:30 AM to 1:30 PM (3 hours) |

| Total Marks | 80 |

| Mode | Offline (Pen and Paper) |

| Time Duration | 3 Hours |

| Question Paper Sets | Multiple Sets (Set 1, Set 2, Set 3, Set 4) |

CBSE 12th Economics Marking Scheme 2024-25

| Assessment Type | Marks |

| Theory Exam | 80 |

Internal Assessment

| (10+10=20) 10 10 |

| 100 |

CBSE Class 12 Economics Answer Key 2025 Features

- Students can check their answers with the correct answers to know their actual score.

- Students can make an assumption of their score prior to result declaration.

- Knowing which questions did they get wrong helps them to know their weak areas and prepare better for the upcoming exams.

CBSE 12th Economics Answer Key 2025

1. Identify, which of the following is not to be considered while estimating Revenue Deficit of a country. (Choose the correct option) (1 Mark)

(A) Wages and salaries paid by the government

(B) Interest payments made by the Central Government

(C) Direct Tax Collection

(D) Expenditure incurred on construction of flyover

2. Read the following statements: Assertion (A) and Reason (R). Choose one of the correct options given below: (1 Mark)

Assertion (A): In case of public goods no one can be excluded from enjoying the benefits.

Reason (R): Public goods are non-rivalrous and non-excludable in nature.

Options:

(A) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

(B) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A).

(C) Assertion (A) is true, but Reason (R) is false.

(D) Assertion (A) is false, but Reason (R) is true.

3. Value Addition = _____ - Value of Intermediate Consumption. (Choose the correct option(s) to complete the stated formula.) (1 Mark)

(i) Domestic sales

(ii) Sales – change in stock

(iii) Value of output

(iv) (Number of units produced) × (Price per unit)

Options:

(A) (i) and (ii)

(B) (ii) and (iii)

(C) (ii), (iii), and (iv)

(D)(iii) and (iv)

4. Suppose for an economy, autonomous consumption stands as ₹ 100 crore and total consumption is ₹ 130 crore. The value of induced consumption would be ₹ _____ crore. (Choose the correct option to fill up the blank.) (1 Mark)

Options:

(A) 30

(B) 80

(C) 100

(D) 130

5. In Keynesian Economics, _____ starts from the origin and is always drawn at an angle of 45°. (Choose the correct option to fill up the blank.) (1 Mark)

Options:

(A) Consumption curve

(B) Aggregate demand curve

(C) Reference line

(D) Investment curve

6. The monetary policy is formulated by the _____ in the Indian economy. (Choose the correct option to fill up the blank.) (1 Mark)

Options:

(A) Central Government

(B) State Governments

(C) Reserve Bank of India

(D) World Bank

7. To arrive at the value of equilibrium level of income, there must exist an equality between ex-ante _____ and ex-ante _____. (Choose the correct option to fill up the blank.) (1 Mark)

(i) Aggregate Demand, Aggregate Supply

(ii) Aggregate Demand, Savings

(iii) Aggregate Demand, Investment

(iv) Savings, Investment

Options:

(A) (i) and (ii)

(B) (i) and (iv)

(C) (ii) and (iii)

(D) (iii) and (iv)

8. The budget under, which the government may spend an amount equal to the revenue it collects is referred as _____ Budget. (Choose the correct option to fill up the blank.) (1 Mark)

Options:

(A) Surplus

(B) Deficit

(C) Balanced

(D) Deflationary

9. Read the following statements: Assertion (A) and Reason (R). Choose one of the correct options given below: (1 Mark)

Assertion (A): If the value of Marginal Propensity to Save is 0.5, Marginal Propensity to Consume will be equal to Marginal Propensity to Save.

Reason (R): Sum of Marginal Propensity to Consume and Marginal Propensity to Save always equals to unity.

Options:

(A) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

(B) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A).

(C) Assertion (A) is true, but Reason (R) is false.

(D) Assertion (A) is false, but Reason (R) is true.

10. As the Banker to the Bank, Reserve Bank of India performs all functions except _____. (Choose the correct option to fill up the blank.) (1 Mark)

Options:

(A) Purchase and sale of securities on behalf of the general public

(B) Maintaining current account for Commercial Banks

(C) Clearing and settlement of Interbank transactions

(D) Facilitating governmental transactions

11. (a) "The government generally levies higher Goods and Services Tax (GST) on socially undesirable products like cigarettes, tobacco, liquor etc."

Identify and explain the indicated government budget objective in the above statement. (3 Marks)

Correct Answer:

The government budget objective indicated in the statement is "Regulating Consumption of Harmful Goods" under Fiscal Policy Measures.

- Higher GST on harmful goods such as cigarettes, tobacco, and liquor discourages their consumption.

- It is part of the "Sin Tax" concept, aiming to reduce the negative externalities associated with these products.

- It also helps the government generate additional revenue while promoting public health.

OR

(b) Two friends Ramesh (a software engineer) and Pihu (a bakery owner) are discussing their contribution to the nation's economy through tax payments. Ramesh earns ₹ 8,00,000 per year, which makes him liable to pay income tax. Pihu pays Goods and Service Tax (GST) on the sale of cakes and pastries.

On the basis of the given text, identify whether Ramesh is paying a direct tax or an indirect tax. Explain valid differences between two types of taxes. (3 Marks)

Correct Answer:

- Ramesh is paying a Direct Tax (Income Tax), while Pihu is paying an Indirect Tax (GST).

- Differences Between Direct and Indirect Taxes:

| Basis | Direct Tax | Indirect Tax |

| Definition | Paid directly by individuals/corporations to the government | Levied on goods and services, collected by businesses and passed to the government |

| Burden of Tax | Cannot be shifted to another person | Can be shifted to the end consumer |

| Examples | Income Tax, Wealth Tax | GST, Excise Duty, Custom Duty |

| Impact | Affects higher-income individuals more | Impacts all consumers equally, regardless of income |

SECTION - B

(Indian Economic Development)

18. In recent years, all the adults are encouraged to open bank accounts as a part of a scheme known as _____. (Choose the correct option to fill up the blank.) (1 Mark)

Options:

(A) Jan-Dhan Yojana

(B) Jan-Aushadhi Yojana

(C) Jan-Soochna Yojana

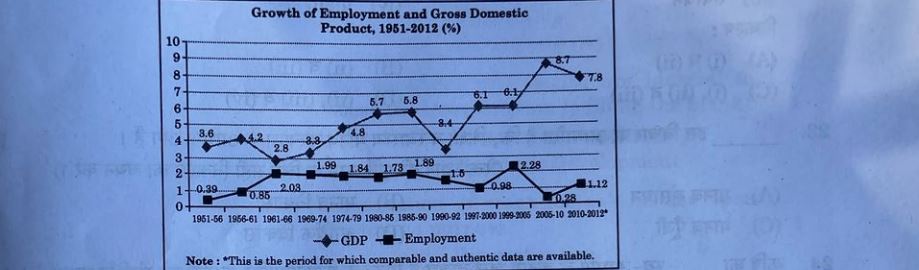

(D) Jan-Arogya Yojana

19. The given chart indicates the problem of _____ in the Indian Economy, post 1990-92. (Choose the correct option to fill up the blank.) (1 Mark)

Options:

(A) Informalisation of Workforce

(B) Casualisation of Workforce

(C) Jobless Growth

(D) Formalisation of Workforce

20. Read the following statements carefully: (1 Mark)

Statement 2: Environmental crisis happens when the rate of resource extraction is less than that of regeneration of resource.

In the light of the given statements, choose the correct option from the following:

Options:

(A) Statement 1 is true and Statement 2 is false.

(B) Statement 1 is false and Statement 2 is true.

(C) Both statements 1 and 2 are false.

(D) Both statements 1 and 2 are true.

21. _____ are the people who operate their own farms/enterprises. (Choose the correct option to fill up the blank.) (1 Mark)

Options:

(A) Hired Workers

(B) Casual Wage Workers

(C) Regular Salaried Employees

(D) Self-Employed

22. Agricultural marketing is a process that involves the _____ of agricultural commodities. (Choose the correct option to fill up the blank.) (1 Mark)

Options:

(A) (i) and (ii)

(B) (ii) and (iii)

(C) (ii), (iii), and (iv)

(D) (iii) and (iv)

Correct options include:

- (ii) Processing

- (iii) Assembling

- (iv) Grading

These are key steps in agricultural marketing to improve quality and distribution.

23. _____ is based on the idea that education and health are integral to human well-being. (Choose the correct option to fill up the blank.) (1 Mark) Options:

(A) Human Resource

(B) Human Development

(C) Human Capital

(D) Economic Development

24. _____ of agriculture refers to the production of crops for sale in the open market rather than for self-consumption purposes. (Choose the correct option to fill up the blank.) (1 Mark)

Options:

(A) Commercialisation

(B) Diversification

(C) Digitisation

(D) Modernisation

25. Read the following statements carefully: (1 Mark)

Statement 2: Under the commune system, professionals were sent to work and learn from the countryside.

In the light of the given statements, choose the correct option from the following:

Options:

(A) Statement 1 is true and Statement 2 is false.

(B) Statement 1 is false and Statement 2 is true.

(C) Both statements 1 and 2 are true.

(D) Both statements 1 and 2 are false.

26. Identify the options that emphasize the role of information and technology. (1 Mark)

Options:

(i) Achieving sustainable development

(ii) Attainment of food security

(iii) Disseminates information regarding emerging technologies

Options:

(A) Only (i)

(B) Only (ii)

(C) (i) and (ii)

(D) (i), (ii), and (iii)

27. Read the following statements: Assertion (A) and Reason (R). Choose one of the correct options given below: (1 Mark)

Assertion (A): Under the land reforms, the Indian government fixed the minimum land size which could be owned by an individual.

Reason (R): The purpose of land ceiling was to avoid the concentration of land ownership in a few hands.

Options:

(A) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

(B) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A).

(C) Assertion (A) is true, but Reason (R) is false.

(D) Assertion (A) is false, but Reason (R) is true.

28. (3 Marks)

(a) Medhya and Danish both had their own farms.

Medhya invested in a few agricultural courses, learned modern farming techniques, and trained her laborers on best practices related to soil fertility, crop management, and pest control.

Whereas, Danish invested heavily in purchasing advanced farming machinery, irrigation systems, and high-quality seeds.

Do you agree that Danish had made an investment in human capital?

Give a valid reason in support of your answer.

Answer:

No, Danish did not make an investment in human capital. Human capital refers to improvements in skills, education, and health that enhance productivity. Medhya’s investment in training and education aligns with human capital investment, whereas Danish’s focus on machinery and seeds relates to physical capital.

OR

(b) "Expenditure on preventive medicine, curative medicine, and social medicine helps in building human capital and economic development."

Do you agree with the given statement? Give valid arguments in support of your answer.

Answer:

Yes, investment in healthcare strengthens human capital. Preventive and curative medicine improves workforce productivity by reducing disease and increasing life expectancy. A healthier population results in a stronger economy due to higher efficiency and lower medical expenses.

29. (3 Marks)

Briefly explain the dual pricing policy adopted by China.

Answer:

China’s dual pricing policy allowed industries and farmers to buy inputs at subsidized prices while selling surplus at market rates. This approach encouraged productivity and a gradual shift towards a market economy, balancing state control and economic liberalization.