The MBA in Finance is one of the best business qualifications online today, combining management education with finance knowledge. This degree provides expertise in financial modeling, portfolio management, risk assessment, and informed decision-making, including capital investment.

The MBA Finance career scope is large with many different fields, including corporate finance, investment banking and financial planning, and business risk management. In India, the career scope of MBA Finance is expanding rapidly, with the financial services sector contributing over 6% to the GDP and employing millions of professionals. Finance jobs are projected to grow at an annual rate of 8.5%. The financial services sector has strong potential for growth with the emergence of fintech and the digitization of banking driving demand.

According to the Bureau of Labor Statistics 2024-2034 Employment Projections, employment of business and financial occupations is projected to grow faster than the average for all occupations from 2024 to 2034. An average of approximately 942,500 openings for business and financial jobs is projected each year, on average, over the decade, as a result of employment growth and replacement needs.

Certain occupations in finance have exceptionally strong projected growth:

- Financial Analysts are projected to grow by 6% from 2024-2034, with approximately 29,900 openings each year.

- Financial Managers are projected to grow by 15%, which is much faster than average, from 2024-2034, with approximately 74,600 openings each year.

Source: BLS Business and Financial Occupations Report

In addition, according to GMAC, average MBA graduates make approximately a 46% salary increase upon completion of their MBA degree. Given, the Top MBA professionals earn up to ₹1 - ₹5 crores more than a non-MBA professional, about 50% of MBA graduates globally will eventually become Senior Managers or Board Directors.

The global median salary estimates for Finance Managers with an MBA are $131,706, with 77% of employers accessing MBA talent wherever possible. The growing number of MBA finance jobs over the years, salary vs. skill vs. increasing demand, is a key decision criterion for overly prepared and motivated professionals to determine which career to pursue.

What Are My Options After an MBA In Finance?

There are many different professional areas of work in MBA Finance jobs in India, with many fast-growing areas for finance professionals as businesses expand globally. Some options from the very high-status and well-paying corporate finance positions or government banking positions to work-from-home employment opportunities provide very flexible hours, promising rewarding career paths for MBA Finance grads. Check out the possibilities in the MBA Finance career, which gives aspirants the choice of several rapidly growing fields:

- Corporate Finance: Overseeing budgets, investments, and financial planning.

- Investment Banking: Advising on mergers, acquisitions, and fundraising.

- Equity Research: Analyzing data and trends regarding the performance of financial securities.

- Financial Consulting: Advising companies regarding their financial budget, planning, and analysis.

- Risk Management & Treasury: Safeguarding the company's assets and optimizing liquidity for its operations.

- Government and Public Sector roles: Opportunities in organizations such as the RBI, SEBI, and Public Sector Undertakings (PSUs).

- Leadership roles in MNCs: Global exposure, well-compensated roles in leading companies.

10 Best-paying MBA Finance Jobs in India

An MBA with a specialization in finance has grown tremendously over the past decade, spanning beyond traditional careers in banking and accounting to modern careers in Fintech, Risk Management, and Corporate Strategy. Therefore, a career after an MBA in finance is very flexible and lucrative for graduates who seek longevity.

Finance Graduates from the best MBA Colleges in India have an average salary of $186,000 within three years of graduating with an MBA, which displays the value of the degree as a career booster. Below is the MBA Finance career scope, job responsibilities, job growth timeline, and salaries in some of the top finance careers.

Chief Financial Officer (CFO)

CFOs are the financial backbone of organizations. They are responsible for strategic planning with a long-term vision, risk management, capital allocation, financial reporting, and compliance, while aligning strategic financial goals with the overall business objectives.

Post-COVID, strategic CFOs are in demand across industries, including IT, banking, retail, manufacturing, and healthcare, with the increasing use of technology. Organizations are expanding, and startups and MNCs are eager to fill gaps in experienced finance leaders.

Organizations value CFOs who have skills in digital finance transformation, knowledge in ESG and corporate sustainability matters, as well as experience working across global markets after the pandemic.

Career Path

Below is the typical career path to becoming a CFO after completing an MBA in Finance. The role of the CFO, due to the expected breadth of experience and skill needed, typically requires the following deferred career pathway to reach the role of Chief Financial Officer in an organization.

- Financial Analyst → Senior Analyst → Finance Manager → Director of Finance → Chief Financial Officer (Requires 15+ years of progressive experience.)

Average Salaries

The Average salary for a CFO with an MBA in Finance is given below:

- India: The entry-level average salary for a CFO is ₹1–1.5 CPA, while an experienced CFO can earn up to ₹1.5–3+ CPA (experienced)

- USA: $200,000–$1M (annually). The average total salary is $574,000.

Investment Banker

Investment bankers work as advisors on M&A transactions, IPOs, fundraising, and the overall financial restructuring process. Investment banks help their clients build models, conduct due diligence, and execute substantial financial transactions. There are opportunities with global players such as Goldman Sachs and JP Morgan, smaller boutique firms, and regional players.

The IPO boom in India, as well as M&A growth, has increased demand for National Bank-focused experienced Investment bankers, which only promises to continue to grow.

Career Path

This systematic hierarchy shows the standard career ladder in investment banking and high-level finance jobs, to progress professionals from entry-level technical practitioners to senior business leaders and rainmakers.

- Analyst (0 to 3 yrs) → Associate → VP → Director → MD

Average Salaries

The Average salary for an Investment Banker after an MBA in Finance in India and the USA is mentioned below:

- India: ₹12–14 LPA (Analyst) → ₹1–2 crore (Director/ED) or

- USA: $100K (Analyst) → MD (top firms $2M+)

Private Equity Associate

Private Equity (PE) Associates play a vital role in the identification and evaluation of investment opportunities. They create financial models, conduct due diligence, generate reports, and support portfolio companies as they go through a growth phase.

This is among the most comprehensive career opportunities in private equity funds, venture capital firms, and family offices. Professionals gain valuable experience in a variety of industries, including technology, healthcare, and infrastructure.

India's private equity industry is growing rapidly, especially in sectors driven by technology and healthcare. Increased domestic activity and overseas deal volume are driving demand for talented finance professionals in the private equity industry.

Career Path:

- Analyst → Associate → Senior Associate → Vice President → Principal → Partner

Average Salary:

- India: ₹12–18 LPA (Associate) → ₹25-40 LPA (VP)

- USA: $150,000–$500,000+ (in total compensation)

Finance Manager

Finance Managers are responsible for budgeting, forecasting, compliance, and financial planning. They manage finance teams, ensure compliance with regulations, and provide examination and insights to help inform financial decisions that affect business strategy. Of all the MBA in Finance career options, this is among the most versatile across sectors, including FMCG, IT, Manufacturing, banking, and start-ups.

There are plenty of opportunities to take on finance manager positions in domestic as well as multinational companies. Finance Managers with expertise in data analytics, process automation, and strategic planning are in high demand.

Career Path:

- Financial Analyst → Senior Analyst → Assistant Finance Manager → Finance Manager

Average Salaries:

- India: ₹5–8 LPA (entry-level) → ₹30 LPA (senior level)

- USA: $68,000–$130,000

Portfolio Manager

A Portfolio Manager models investment strategy, develops benchmarks, manages accounts, and monitors performance. Portfolio Managers will assess risk, study markets, and maximize returns for their clients.

A high demand for Portfolio Managers exists in asset management companies (AMCs), mutual funds, hedge funds, pension funds, and private wealth management firms. For a portfolio manager, there has never been a better time with the rise of retail investors as well as the growing AUM in India. This has contributed to higher demand for portfolio managers.

Career Path:

- Research Analyst → Analyst → Portfolio Manager → Senior Portfolio Manager

Average Salaries:

- India: ₹15–55 LPA

- USA: $100,000–$250,000+

Hedge Fund Manager

Hedge Fund Managers carry out the day-to-day operations on investment portfolios, follow advanced trading strategies, and attempt to generate performance or "alpha" for their investors. Part of their responsibilities involves risk management and liaising with investors.

Hedge Fund "careers" are considered niche but are among the most coveted MBA Finance jobs in India or abroad. Asset managers, especially hedge funds (none in India), proprietary trading firms, and alternative investment firms, are primary job categories. Allocating capital and engaging in trading securities typically occur very quickly.

Career Path:

- Analyst → Portfolio Manager → Senior Portfolio Manager → Fund Manager/Partner

Average Salaries:

- India: ₹15–50+ LPA

- USA: $192,000 average, millions at the senior level.

Business Analyst (Finance)

A finance Business Analyst acts as the liaison between IT and business. A business analyst will carry out some analytics on financial data, provide data-driven insights for decision-making, and establish processes.

This is a critical role and in demand across IT, fintech, consulting, and manufacturing. This role is a strong entry point for a career after completing an MBA in Finance.

Career Path:

Junior Business Analyst → Business Analyst → Senior Analyst → Lead Analyst → Analytics Manager

Average Salaries:

- India: ₹6-20+ LPA

- USA: $75,000-$120,000

Equity Research Analyst

Equity Research analysts research companies, track sectors, create valuation models, and publish reports, making actionable investment recommendations. These roles exist in brokerage firms, investment banks, asset management firms, and hedge funds.

Career Path:

- Research Associate → Analyst → Senior Analyst → Vice President → Director → Managing Director

Average Salaries:

- India: ₹8-25 LPA

- USA: $125,000 - $600,000+

Risk Manager

Risk Managers identify, assess, and control risks of various types, including credit risk, market risk, operational risk, and regulatory risk. They develop a risk framework and ensure adherence to financial legislation.

Risk Management is an important function in a variety of organizations, including banks, insurance companies, fintechs, and consulting firms. As regulatory requirements devour more money and time, Risk Management has risen to the perfect point in career history, offering exciting, challenging, and stable careers for MBA Finance graduates.

Career Path:

- Risk Analyst → Risk Manager → Senior Risk Manager → Chief Risk Officer

Average Salaries:

- India: ₹6–50+ LPA

- USA: $70,000–$250,000+

Financial Controller

Financial Controllers are responsible for ensuring the accuracy and integrity of financial statements by managing the accounting function, compliance, and reporting. They make sure that financial reports are accurate and comply with accounting standards, budgets are met, and businesses are protected during strategic decision-making.

This description is applicable in every country and almost every kind of organization, from startup businesses to medium-sized organizations and large MNCs. It's a common pathway for people wanting to become CFOs within an organization.

Career Path:

- Accountant → Senior Accountant → Manager → Assistant Controller → Financial Controller → CFO

Average Salaries:

- India: ₹6–40+ LPA

- USA: $85,100–$250,000+

Top 10 MBA Finance Jobs in the Government Sector

Below is the list of the Top 10 MBA finance careers in the Governmnt sector which can be gained through specifi govenrment exams.

RBI Grade B Officer

RBI Grade B Officers administer the monetary policy of India, regulate the banking sector, conduct research into the economy, and monitor the price of currency. RBI Grade B is one of the most lucrative MBA Finance career options in the government sector, which contributes directly to the economic development of nations. The digitalisation of banking and fintech has made it a great time to be an RBI officer in light of increased regulatory focus on financial inclusion and cybersecurity.

Government Exam:

- RBI Grade B Exam (Phase I, Phase II, Interview)

Average Salaries:

- The average salary for an RBI Grade B Officer is ₹17–20 LPA for entry-level and ₹30–40 LPA for senior positions.

SEBI Grade A Officer

SEBI Officers regulate capital markets by overseeing securities trading, regulatory compliance, and investor protection. This is another important MBA Finance career option for those interested in capital markets and regulatory frameworks. With the IPO boom in India, there is a high demand for SEBI Officers given the increased activity in the retail investor space.

Government Exam:

- SEBI Grade A (Assistant Manager) Exam (Written + Interview)

Average Salaries:

- Entry Level Salary: ₹10 – 15 LPA

- Senior Level Salary: ₹25+ LPA

NABARD Grade A Officer

NABARD Officers work on designing agricultural credit schemes, funding rural developments, and implementing the financial inclusion scheme. This MBA Finance career suits professionals passionate about rural finance and development finance. NABARD is becoming more important with trends in sustainable agriculture and green financing.

Government Exam:

- NABARD Grade A Examination (Phase I, Phase II, and Interview)

Average Salaries:

- Entry Level Salary: ₹7 – 14 LPA

- Senior Level Salary: ₹20 – 25 LPA

Indian Economic Service (IES) Officer

IES Officers draft policies, macroeconomic trends, and work with the Ministry of Finance in an advisory role. Another respected MBA Finance career path, IES offers opportunities to impact India’s economic planning directly. Rapid globalisation and the digital economy are making a strong case for increasing the need for economic planners to make sense of India’s economy.

Government Exam:

- UPSC Indian Economic Service (IES) Examination

Average Salaries:

- Entry Level Salary: ₹15 – 20 LPA

- Senior Level Salary: ₹30+ LPA

Indian Revenue Service (IRS) Officer

IRS Officers are responsible for ensuring the administration of direct taxes, audits, and revenue collection from taxation. The IRS offers a respected status, job security, and can provide an extraordinary experience, as accountants and finance professionals will understand the taxation policy and be responsible for tax management. The government's commitment to digital taxation and compliance has culminated in the increased demand for IRS professionals.

Government Exam:

- UPSC Civil Services Examination (IRS – Income Tax)

Average Salaries:

- Entry Level Salary: ₹10 – 18 LPA

- Senior Level Salary: ₹25 – 35 LPA

Central Excise & Customs Inspectors (C&CE)

C&CE Inspectors enforce customs laws, collect indirect taxes, and enforce laws against smuggling. If you are interested in regulatory and compliance-oriented roles, a C&CE Inspector is an excellent MBA Finance career path. With the growth in global trade, customs enforcement officers increasingly play a key role in our economy.

Governement Exam:

- UPSC Civil Service or SSC CGL (for Inspector roles in CBIC)

Average Salary:

- Entry Level Salary: ₹7 – 12 LPA

- Senior Level Salary: ₹20+ LPA

PSU Finance Manager/ Management Trainee

Public sector undertakings (PSU) finance managers complete budgeting, investment, cost, and financial reporting, and each hiring is done on an individual basis. A PSU Finance Manager presents a strong, stable MBA Finance career option with opportunities at India's largest public institutions, including ONGC, NTPC, and IOCL. Public enterprise finance hiring is being fueled by major government investments into oil and energy and infrastructure projects.

Governement Exam:

- GATE or PSU-specific management trainee (MT) exams

Average Salaries:

- Entry Level Salary: ₹8–16 LPA

- Senior Level Salary: ₹25–30 LPA

Indian Railways Management Service (IRMS) Officer

Railway financial management is assigned to IRMS officers, including project budgets, audits, and logistics planning. An MBA Finance career path that is unlike any of the above options because it incorporates a finance function in large-scale capacity infrastructure management within the Indian Government. Railway modernization and privatization have created an increased need for financial management due to increased fiscal resources and a management necessity.

Governement Exam:

- UPSC IRMS examination (Civil Service route)

Average Salary:

- Entry Level Salary: ₹10–12 LPA

- Senior Level Salary: ₹20–25 LPA

CAG Officer / Budget Analyst

CAG Officers audit government spending, analyze budgets, and ensure financial accountability. It is a high-impact Career in MBA Finance, giving professionals a unique opportunity to contribute to the allocation of resources within government and influence governance. Increasing government expenditure has created a requirement for more budget analysts and auditors.

Governement Exam:

- UPSC Civil Services Examination or CAG-specific recruitment

Average Salaries:

- Entry Level Salary: ₹8–14 LPA

- Senior Level Salary: ₹20–25 LPA

Defence Services Finance & Logistics Officer

These officers predominantly function in the financial budgeting, procurement, and financial logistical discipline of the Army, Navy, and Air Force. This can be an adventurous and rewarding career in MBA Finance for individuals whose financial expertise is complemented by a national duty. The increase in defence budget and modernization within the Indian defence services has widened financial management roles in logistics.

Government Exam:

- CDS (Combined Defence Services) Officer Recruitment or SSC Officer Recruitment

Average Salaries:

- Entry Level Salary: ₹10–13 LPA + Allowances

- Senior Level Salary: ₹20–30 LPA

Top 10 MBA Finance Job Roles for Freshers

MBA finance graduates can pursue roles such as Investment Banker, Equity Analyst, Corporate Finance Director, Financial Consultant, and Treasury Director. Each of these will have different career paths and a salary range.

An MBA in Finance career offers some of the most lucrative opportunities in banking, consulting, corporate finance, and fintech. Most new graduates will earn between ₹4–12 LPA, whereas graduates from the tier-1 MBA colleges often start at ₹18–30 LPA. Here are 10 of the best MBA Finance job roles for freshers, including salaries, responsibilities, and the best companies to work for.

Financial Analyst

Review the financials of the company, allocate budgets, develop financial models, and prepare reports for senior management. It is a highly in-demand entry-level position with ample opportunities in MNCs, consulting firms, and investment banks.

Average Salary:

- The Average salary in a Financial Analyst career after an MBA in Finance is ₹4 - 6 LPA, while graduates from Tier 1 colleges can earn a salary up to ₹10 - 15 LPA.

Top recruiting Firms:

- Deloitte

- EY

- PwC

- KPMG

- Accenture

- Infosys

- ICICI Bank

- HDFC Bank

Investment Banking Analyst

Work on M&A deals, build financial models, conduct due diligence, and prepare pitch books. One of the highest-paying jobs after an MBA in Finance is with a fast-track career in global banks.

Average Salary:

- The Average salary in an Investment Banking Analyst career after an MBA in Finance is ₹6 - 10 LPA, while graduates from Tier 1 colleges can earn a salary up to ₹20 - 25 LPA.

Top recruiting Firms

- Goldman Sachs

- JP Morgan

- Morgan Stanley

- Citi, Barclays

- Avendus Capital

Credit Analyst

Assess the creditworthiness of borrowers, evaluate the value of loan applications, and oversee credit portfolios. It's an essential MBA Finance job in banks, NBFCs, and credit rating agencies.

Average Salary:

- The Average salary in a Credit Analyst career after an MBA in Finance is ₹5 - 7 LPA

Top recruiting Firms:

- CRISIL

- ICRA

- CARE Ratings

- ICICI Bank

- SBI

- Axis Bank

- Bajaj Finance.

Risk Management Associate

Identify risks, create mitigation strategies, and ensure compliance with regulatory policies. Rising due to increased regulations and digital risks.

Average Salaries:

- The Average salary in a Risk Management Associate career after an MBA in Finance is ₹5–8 LPA

Top Recruiting Firms:

- HSBC

- Standard Chartered

- ICICI Lombard

- HDFC Bank

- Axis Bank

- Big 4 consulting firms.

Financial Planning & Analysis (FP&A) Associate

Assist with budgets, forecasts, and variances to help with strategic decision-making. Fast growth toward leadership roles in corporate finance due to limited FP&A positions.

Average Salaries:

- The Average salary in a Financial Planning & Analysis Associate career after an MBA in Finance is ₹6–8 LPA

Top Recruiting Firms:

- Unilever

- Nestlé

- ITC

- Reliance

- TCS

- Infosys

- Accenture

Management Trainee

Experience multiple finance functions through rotation to gain experience in corporate finance, treasury, and compliance. Excellent long-term growth opportunities with leadership exposure.

Average Salaries:

- The Average salary in a Management Trainee career after an MBA in Finance is ₹5–8 LPA

Top Recruiting Firms:

- Hindustan Unilever

- ITC

- Reliance

- Tata Group

- Mahindra

- Aditya Birla Group.

Business Analyst (Finance)

Act as the connector between business and finance functions through data analysis, process improvements, and support with strategy. Growing rapidly in demand, especially for companies engaged in IT, consulting, and fintech.

Average Salaries:

- The Average salary in a Business Analyst career after an MBA in Finance is ₹5–7 LPA

Top Recruiting Firms:

- Cognizant

- Wipro

- TCS

- Infosys

- Capgemini

- Accenture

- Paytm

- Razorpay

Corporate Finance Associate

Provide support on capital raising, aid in investor relations, and assistance with treasury functions. A hybrid role offering corporate experiences for Indian conglomerates and with international multinational corporations.

Average Salaries:

The Average salary in a Corporate Finance Associate career after an MBA in Finance is ₹4–7 LPA

Top Recruiting Firms:

- Reliance

- Tata Group

- Adani

- Flipkart

- Amazon

- Infosys

- Mahindra

Equity Research Associate

Review companies and industries, create models to evaluate companies and sectors, and provide research reports. A glamour role within investment banks, brokerage houses, and asset management companies.

Average Salaries:

The Average salary in an Equity Research Associate career after an MBA in Finance is ₹6–8 LPA

Top Recruiting Firms:

- Goldman Sachs

- JP Morgan

- Motilal Oswal

- ICICI Securities

- Kotak Securities

Banking Relationship Manager

Manage account portfolios, cross-sell other products and services, and meet branch/business sales targets. This is a client-facing role suitable for MBAs with a strong aptitude for sales and interpersonal skills.

Average Salaries:

The Average salary in a Banking Relationship Manager career after an MBA in Finance is ₹3–5 LPA

Top Recruiting Firms:

- HDFC Bank

- ICICI Bank

- Axis Bank

- Kotak Mahindra

- Yes Bank

- SBI

MBA Finance Salary

Pursuing an MBA in Finance is one of the Best-paying MBA specializations and provides professionals with good career scope and high salary packages. Regardless of whether you are a fresher or an experienced executive, a career after an MBA in Finance will allow you to potentially experience high earnings and long-term growth in areas such as investment banking, corporate finance, consulting, and risk management.

Current MBA Finance Salary Structure

The entry-level MBA Finance graduates typically have a starting package from ₹6-12 LPA, with MBA Finance salary for freshers in India averaging ₹8 LPA across industries. There are many opportunities to grow these salaries as professionals become more advanced and experienced in certain important areas.

- Fresh Graduates (0–2 years): ₹50,000 – ₹85,000 per month

- Mid-level professionals (5–10 years): ₹1.25 – ₹2.1 lakhs per month

- Senior leadership (CFO/VP level): ₹3.5 – ₹6 lakhs per month or more

Compared to this, graduates from the top B-schools in India, such as IIMs, ISB, and XLRI, get an average salary of ₹25–30 LPA, which is typically 30–50% higher than their peers at graduation.

MBA in Finance Per Month Salary

The average salary of an MBA in Finance fresher is around ₹50,000– ₹85,000/month. After 5 – 10 years of experience, the salary can go up from ₹1.25 lakhs– ₹2.1 lakhs/month. The salary for Head of Finance roles or CFO goes upwards of ₹3.5 lakhs/month.

MBA Finance Salary Progression by Experience

Typically, an MBA Finance career development path tends to progress as follows:

- 0–2 years: ₹6–10 LPA starting salary

- 3–7 years: ₹12–18 LPA when you are seen as capable

- 8–15 years: ₹20–35 LPA up to senior management roles.

- 15+ years: ₹40+ LPA at the C level (CFO, Finance Director, etc.)

Factors Influencing the MBA Finance Salary

Several factors will influence MBA Finance career opportunities and the salary structure that graduates can expect in India:

Type of Institution

- An alumnus from a top institute such as IIM, ISB, or XLRI is able to command between 30–50% higher pay than his counterparts in other MBA programmes.

- Employers pay higher wages because those institutions develop a strong alumni network and rigour in the programme, and are also able to bring more brand benefit to the resumes of their graduates. As such, institutional pedigree is among the strongest salary drivers.

Industry Choice

- The industry that you work in makes a huge difference to your salary package. Investment Banking, consulting, and financial services remain the best-paying MBA Finance jobs in India.

- On the flip side, traditional sectors such as manufacturing or public enterprise may offer lower packages but often come with job security and systematic advancement.

A geography restricted by pay

- Geography is also important. You can expect your salary package to be higher in Mumbai, Bengaluru, and Delhi-NCR (at least between 15-25% more than a Tier 2 or Tier 3 city).

- The incidence of finance professionals and the cost of living significantly affect the MBA salaries in different cities.

Specialisation and Skills

- Employers are willing to compensate you at a higher level for specialist or new skills. Those with proven skills in financial modelling, risk analytics, blockchain, or ESG Finance. For example, an MBA Finance professional earns 20–40% higher salaries than someone who enters finance with knowledge of general finance skills.

- These specializations and technical skills are becoming differentiators. It is obvious, in today’s economy, that companies are always looking for professionals with these areas of expertise, and that advanced skills are an important engine for long-term growth in a career after an MBA in Finance.

Long-Term MBA Finance Career Growth Scope

The outlook for an MBA finance career trajectory is extremely positive. Generally, within their first decade, professionals will typically enjoy 50% - 70% salary growth and may double their starting salary if they are standout performers. Often, at the senior levels, executives can enjoy a 200% - 300% increase over their original pay, especially in the top-paying jobs after an MBA in Finance, such as:

- Investment Banking

- Private Equity

- Multinational Corporate Finance

Which job has the highest salary in MBA Finance?

Investment banking, private equity, and CFO positions are considered the best-paying MBA finance jobs in India, with Senior roles often paying upwards of ₹40 LPA.

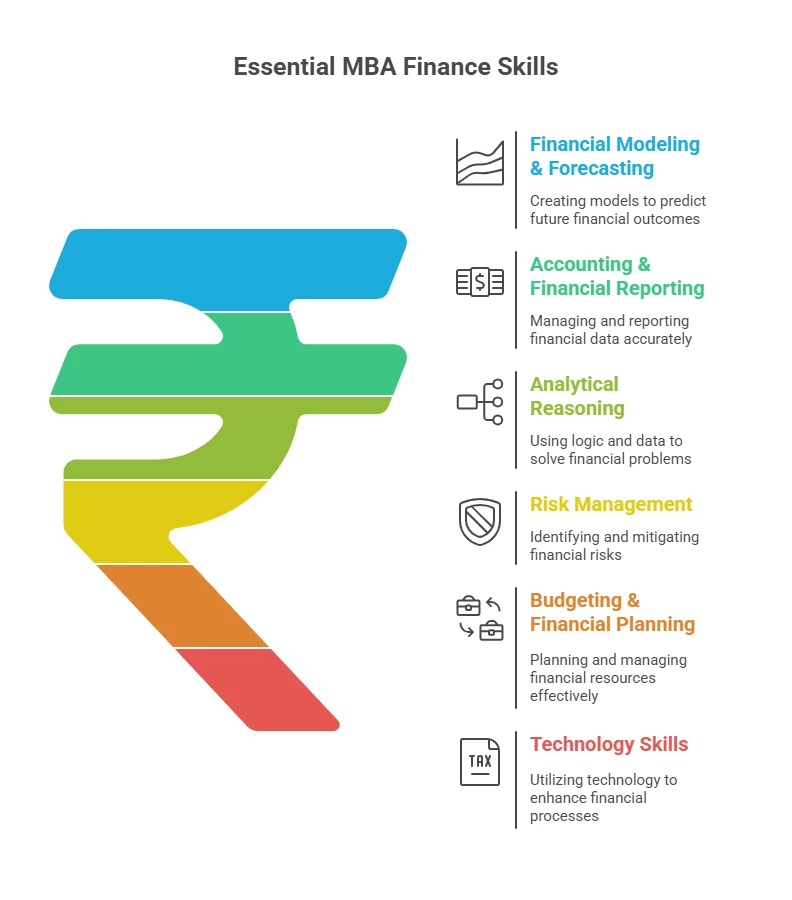

Technical Skills Employers Look for in MBA Finance Graduates

MBA finance graduates, employers look for professionals able to balance technical know-how with analytical thought and leadership. To thrive in a competitive financial services environment, candidates should be able to demonstrate a combination of finance skills, technology knowledge, and interpersonal skills. Here are the essential MBA finance technical skills that employers look for.

Financial Modeling & Forecasting

- They are essential for many finance roles and are used to forecast revenues, expenses, and cash flows. College MBA Finance graduates use scenario analysis and forecasting methods to inform strategic decisions in business.

Accounting & Financial Reporting

- A solid understanding of a balance sheet, income statement, and cash flow statement is very fundamental. Employers value those candidates who can prepare transparent accounting reports, comply with regulatory requirements, and report on their financial wellness to their stakeholders.

Analytical Reasoning

- Analytical reasoning is one of the most important skills to have for an MBA in Finance job. The difference between a good decision and a bad decision, with respect to financial performance, is fine. Analytical reasoning is the process of confirming market trends, risk evaluation, and making meaning from large sets of data to inform decision-making.

Risk Management

- Companies are actively seeking finance professionals to identify, measure, and manage risk (credit risk, market risk, operational risk, etc.). Maintaining a strong risk framework protects company assets and ensures business continuity.

Budgeting & Financial Planning

- Whether recent graduates from an MBA program learn budgeting and financial planning, institutions prefer those graduates who have skills in resource allocation, variance analysis, and performance monitoring and accountability to ensure the organization does not run over budget and fails to become profitable.

Technology Skills

- In a digital finance ecosystem, there's a preference, or requirement, to know Excel (i.e., pivot tables and macros), ERP systems (i.e., Oracle or SAP), and BI systems (Power BI, SQL, Tableau). These skills are expected to help you improve accuracy, automation, and productivity in your position.

Read More: Apart from Technical Skills, other skills, such as Communication skills, need to be mastered to become an Experienced Professional in an MBA in Finance. Check it out here.

Top Companies hiring MBA Finance Graduates

Today, MBA Finance professionals are a necessity in industries across the board, whether for MNCs, startups, or government organizations. They play a critical role in how resources are allocated, in evaluating the risk profile of potential projects, and in making decisions on where strategic investments are made.

The growth of globalization and the digital transformation of finance means the MBA Finance career path should see extraordinary growth in these areas in the future. According to GMAC, 90% of corporate recruiters hired an MBA graduate last year. This provides strong MBA Finance job market demand in India and across the world.

Company | Average Salary | Salary Range |

Goldman Sachs | ₹32.9 LPA | ₹23.3 – ₹103.1 LPA |

J.P. Morgan | ₹22.4 LPA | ₹17.0 – ₹50.0 LPA |

Morgan Stanley | ₹25 – 40 LPA | ₹20.0 – ₹70.0 LPA |

Citi | ₹25 – 40 LPA | ₹18.0 – ₹60.0 LPA |

Barclays | ₹20 – 35 LPA | ₹15.0 – ₹55.0 LPA |

Deloitte | ₹20.5 LPA | ₹15.8 – ₹54.7 LPA |

KPMG | ₹20.8 LPA | ₹16.0 – ₹50.0 LPA |

PwC | ₹21.7 LPA | ₹16.2 – ₹55.7 LPA |

EY | ₹18 – 25 LPA | ₹12.0 – ₹45.0 LPA |

HDFC Bank | ₹6.9 LPA | ₹2.5 – ₹19.9 LPA |

ICICI Bank | ₹6 – 12 LPA | ₹4.0 – ₹20.0 LPA |

Kotak Mahindra Bank | ₹8 – 15 LPA | ₹5.0 – ₹25.0 LPA |

Axis Bank | ₹7 – 13 LPA | ₹4.5 – ₹22.0 LPA |

McKinsey & Company | ₹30 – 55 LPA | ₹25.0 – ₹80.0 LPA |

BCG | ₹30 – 55 LPA | ₹25.0 – ₹80.0 LPA |

Bain & Company | ₹30 – 55 LPA | ₹25.0 – ₹80.0 LPA |

Salary Source: 6Figr

.png)

.png)